For Further Study:

- Andrew McClurg, It's a Wonderful Life: The Case for Hedonic Damages in Wrongful Death Cases, Notre Dame Law Review, Vol. 66, p. 57, 1990; Available at SSRN:

- Official Website of the 9/11 Victim Compensation Fund

- Ilya Marritz, “How They Spent It: Recipients Reflect on 9/11 Victim Compensation Fund,” WNYC News (September 6, 2011)

- Book: Kenneth Feinberg, What Is Life Worth?: The Inside Story of the 9/11 Fund and Its Effort to Compensate the Victims of September 11th (2006)

- In re Estate of Ferdinand Marcos Human Rights Litigation (D. Hawaii, 1995)

- W. Kip Viscusi, The Value of Life in Legal Contexts: Survey and Critique

Victim Compensation and Wrongful Death Damages

Compiled by Jonathan White and Jeff Hobday

Introduction

It is no easy task to measure the value of a human life, but courts are routinely asked to make that determination in wrongful death cases, and government agencies must confront this problem when weighing the costs and benefits of new regulation.

Days after the terrorist attacks of 9/11, Congress established a Victim Compensation Fund to aid the families who lost loved ones that day. The 9/11 Victim Compensation Fund relied upon calculations of lost earnings by average work-life expectancy, which is the traditional “human capital” approach of courts.

In a famous class action lawsuit, In re Estate of Ferdinand Marcos Human Rights Litigation, the federal court took into account both human capital and non-economic loss, relying upon inferential statistics to compensate the large class of plaintiffs.

Well-regarded scholars in economics and law, however, recommend a different method of valuation, known as willingness-to-pay or the value of statistical life. Federal agencies employ this methodology when drafting economically significant regulations, as part of the cost-benefit analysis required by Executive Order 12866. The courts have not accepted this statistics-based approach, but it could be a useful alternative or supplement to traditional measurements, particularly in the context of mass tort cases.

Legal Standard for Wrongful Death Compensation

Traditionally, courts have determined damages for wrongful death by calculating the monetary amount the victim could have provided for surviving family members, based upon income at time of death and average work-life expectancies. This is known as valuation by human capital or the pecuniary loss rule.

A minority of state courts and some government programs (such as the 9/11 Fund) compensate for non-economic loss, such as pain and suffering preceding death, loss of companionship, etc. This type of compensation is sometimes referred to as hedonic damages. The concept has been almost universally accepted in the context of personal injury claims, but many jurisdictions have been reluctant to extend the remedy to wrongful death cases because there is no objective measurement of non-economic loss.

The remedy allowed by Michigan Wrongful Death Statute1 provides an example of both hedonic damages and compensation for pecuniary loss. It reads:

"In every action under this section, the court or jury may award damages as the court or jury shall consider fair and equitable, under all the circumstances including reasonable medical, hospital, funeral, and burial expenses for which the estate is liable; reasonable compensation for the pain and suffering, while conscious, undergone by the deceased during the period intervening between the time of the injury and death; and damages for the loss of financial support and the loss of the society and companionship of the deceased."

September 11th Victim Compensation Fund (2001-2003)

The 9/11 Victim Compensation Fund (VCF) was created by Congress (as part of the Air Transportation Safety and System Stabilization Act) to compensate 9/11 victims’ families in exchange for their agreement not to sue the airlines. Ken Feinberg was appointed special master of the fund and personally met with dozens of applicants. According to government statistics, the VCF issued 5,562 awards; the median award for deceased victims was around $1.7 million.

In calculating proper compensation, the VCF relied primarily upon the current value of the victim’s lost earnings. Some of the victims from the World Trade Center were highly paid financial professionals, so the VCF placed a cap on base salary at $220,000. The Fund also provided a presumed award for victims’ non-economic loss: $250,000 plus $100,000 for a spouse and each dependent of the deceased. It was considered "roughly equivalent to the amounts received under existing federal programs by public safety officers who are killed while on duty, or members of our military who are killed in the line of duty…"

Victim Compensation in Marcos and the Use of Inferential Statistics

In re Estate of Ferdinand Marcos Human Rights Litigation (D. Hawaii, 1995)

During his presidency of the Philippines, Ferdinand Marcos’s regime imposed martial law for 14 years – up until the end of his Presidency. During that martial law period, his regime tortured and killed thousands of victims. He also misappropriated millions in U.S. aid for his own personal fortune. In 1986, Ferdinand and his wife Imelda received safe passage by the U.S. military to Hawaii where they lived essentially in exile. Ferdinand died in 1989; however, the victims of his regime brought a class action against Imelda and his estate in the District of Hawaii. Over 10,000 class members joined the suit.

The district court found Marcos liable for all claims brought against him. The court faced a daunting task in compensating so many claimants, many of whom were in the Philippines and unavailable to testify. For the damages phase, the court divided the plaintiffs into three subclasses—those who were tortured, families of those executed, and families of those who disappeared as the result of the government’s actions. The latter two categories were treated as wrongful death claims.

James Dannemiller, an expert in inferential statistics, advised the court-appointed Special Master that “only 137 randomly selected claims, of the 9,541 claims found to be valid, would have to be examined in order to achieve a 95% confidence level that all claims would fall within the ambit of the 137 randomly selected claims."2 The Special Master deposed all 137 plaintiffs before recommending aggregate damages to the jury. He considered the amount of torture suffered, the killing or disappearance, the family’s mental anguish, and aggregate lost earnings. Claims were ranked 1-5, "with 5 representing the worst abuses and suffering."3 For some of the plaintiffs who did not state an income, the Special Master relied upon occupational averages. Thus, the calculations took into account both hedonic loss and human capital valuations.

Strengths and Weaknesses of Valuation by Human Capital

Strengths: In theory, valuation by human capital rewards the plaintiffs the monetary amount that the decedent would have provided for them had he or she lived. It is appealing to judges and juries because damages based on lost earnings are relatively simple to calculate, and the measurement provides a meaningful anchor for jury deliberation.

Weaknesses: The human capital approach creates inequitable results. It highly rewards the survivors of victims from well-paying professions; it disadvantages women and racial minorities who are on average paid unequal salaries. By strict application of human capital calculations, children would have negative net worth, due to the high cost of raising a child; the retired and elderly would have very little.

As Richard Posner and William Landes wrote in an article on the economics of tort law:

The limitation of damages to survivors' pecuniary loss is very peculiar. It implicitly assumes--if, as we generally believe to be the case, tort law seeks to internalize the costs of accidents--that the average person derives no utility from living. He does not work for himself; he works solely for his family. This cannot be right, and it results in a systematic underestimation of damages in wrongful-death cases. 4

Valuation by human capital cannot perfectly measure what the decedent would have been able to provide for surviving family members. It fails to take into account variables such as job loss, promotion, inflation, return on investments, or rates of personal consumption.

Strengths and Weaknesses of Hedonic Damages

Strengths: Damages for so-called “non-economic loss” soften the effect of valuation by human capital. By permitting hedonic damages, courts recognize that the plaintiffs’ loss is much greater than the monetary amount the decedent could have provided.5

Weaknesses: Hedonic damages cannot be calculated with any precision—in fact, many critics consider the awards entirely arbitrary. Some advocates for tort reform believe there should be a ceiling or “cap” on damages for non-economic loss.

The Willingness-to-Pay Method

Governmental agencies, corporations, and even individuals make decisions every day that implicitly place a monetary value on human life. Governmental officials must decide whether to raise or lower speed limits, corporations decide whether to include expensive safety mechanisms on products, and individuals decide whether to drink alcohol, smoke cigarettes, exercise, or drive a car.

Economists have taken advantage of these everyday decisions to develop the willingness-to-pay method for calculating the average value of a human life. Economic studies extort the fact that people are often willing to engage in riskier behaviors or occupations for a price. In essence, these studies calculate the value of human life using the following formula:

![]()

For example, if people, on average, would be willing to incur an additional 1/10,000 chance of death for $400, the value of each individual life would be $4 million.

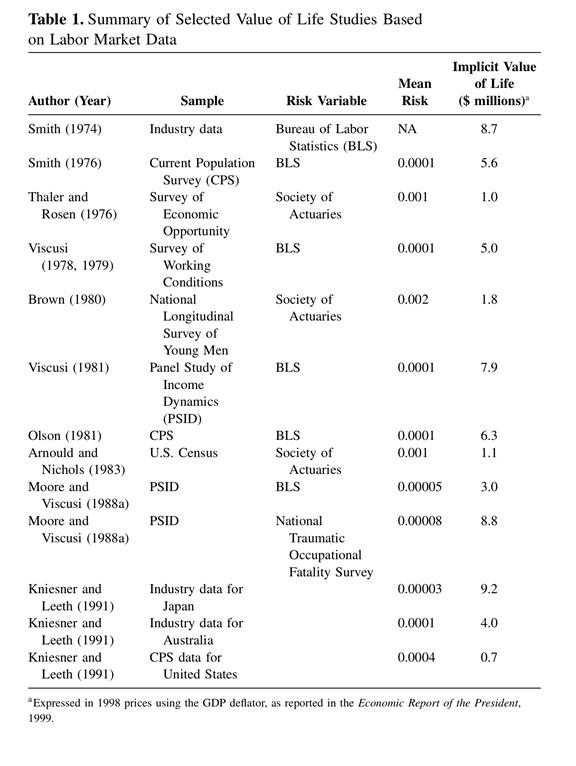

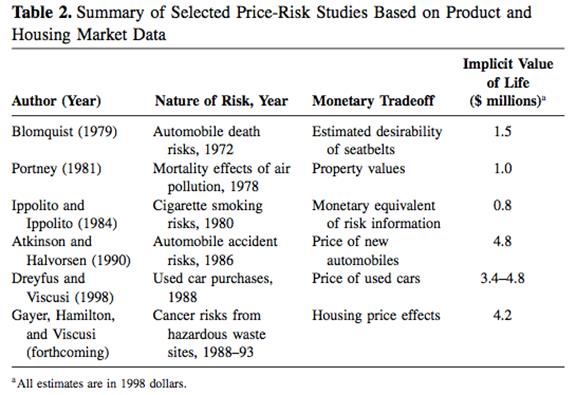

Studies attempting to calculate the value of human life mainly use one of two methods. One group of studies analyzes labor market data to determine how much workers must be paid to perform riskier jobs, while another group of studies analyzes consumer decisions, such as seatbelt use, smoking cessation, and automobile safety, to determine how much people are willing to pay to reduce risk.6

Past studies have found varying, but consistently large values of statistical life:

7

8

Federal agencies have adopted the willingness-to-pay methodology for calculating the value of human life when conducting cost-benefit analysis in implementing new policy. Executive Order 12866 requires federal agencies to conduct formal cost-benefit analysis when considering “significant regulatory action,” in which the proposed regulation would have an annual effect on the economy of $100 million or more, cause a serious inconsistency with another agency’s regulatory action, materially alter the budgetary impact of entitlements, or raise a novel legal or policy issue. If a proposed federal regulation would save lives, the OMB instructs the heads of federal agencies (in Circular A-4) to use the willingness-to-pay approach to convert that saved life into a monetary value when performing cost-benefit analysis.

The willingness-to-pay methodology is not without critics. One major point of criticism is the large variability in the monetary value that various studies find attach to human life (ranging from $700,000 to $9,200,000 in 1998 currency). However, Gary Albrecht argues that this variability is not the result of a flaw in the methodology of the willingness-to-pay approach, but is simply a reflection of differences in the sample population of the studies and small deviations in the types of variables used.9

Others question the soundness of methodology’s underlying assumption that people’s decisions to tradeoff small amounts of risk can be used to accurately calculate the value that they place on their lives. Critics argue that people’s behavior is not always rational with regard to extremely small risks. People purchase lottery tickets even though the expected payout is much lower than the cost of the ticket, and people often improperly overstate the risks of salient, but unlikely events, such as plane crashes, while undervaluing the risks involved in common, seemingly non-risky activities, like riding in a car.10

Application of the Willingness-to-Pay Method in Courts

Many critics also argue that the willingness-to-pay method, while empirically sound, is not useful in calculating the value of an individual’s life, and is therefore not useful for calculating an individual plaintiff’s damages in a wrongful death action. Some worry that allowing experts to testify as to the average value of a life will lead to excessive payouts for plaintiffs and argue that plaintiffs can be better protected by the insurance market.

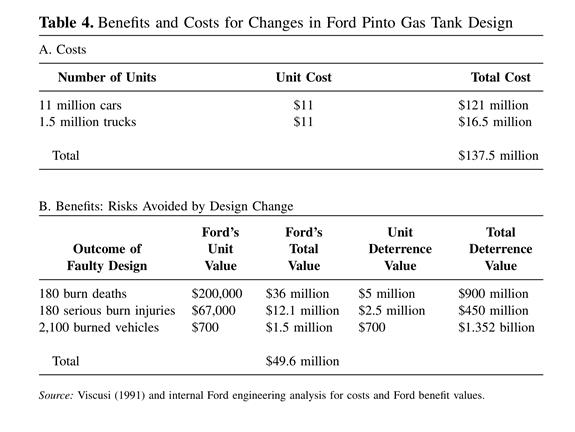

However, economists worry that current methods for the calculation of damages in wrongful death actions result in inefficiently low damage payments, leading to under-deterrence of dangerous corporate decisions. Ford’s decision in the 1970s not to relocate the gas tank on the Ford Pinto is illustrative of this problem. Upon learning of a problem with its gas tank location, Ford had to decide whether to move the location of the gas tank, at a cost of $137.5 million or to make no changes and incur liability for the defect’s resulting injuries and fatalities. Ford estimated that the defect would result in approximately 180 burn deaths and a similar number of burn injuries and estimated its liability for each wrongful death at $200,000 and each burn injury at $67,000. Based on the following calculations, Ford rationally decided to forgo moving the gas tank. 11

If Ford had believed that it would be held liable for total value that society places on human life (which Viscusi estimates at $5 million), Ford would likely have decided to replace the gas tanks. Such a decision is economically more efficient, as it forces Ford to consider the entire societal cost of each wrongful death.13

While proponents of the willingness-to-pay method acknowledge that the method is not meant to calculate the value of a specific individual’s life, they insist that expert testimony on the value of a statistical life would be useful to juries in wrongful death suits. Albrecht argues that expert testimony by economists on the general average value of human life with adjustments based on the individual’s personal characteristics (e.g., age or income) would be helpful to juries in calculating damages in wrongful death actions. While such testimony would not provide a direct estimate of damages to the specific plaintiff involved in the litigation, expert testimony would be particularly useful when traditional valuation methods make it difficult to calculate the plaintiff’s future earnings, perhaps because the plaintiff is unemployed, very young, or retired.14

Courts have consistently rejected the willingness-to-pay method. Courts have routinely rejected expert testimony on the value of statistical life during “Daubert” hearings.

In Ayers v. Robinson (887 F. Supp. 1049 (N.D. Ill. 1995)), the court ruled that an economist’s expert testimony on the value of a statistical life to aid the jury in determining damages in a wrongful death suit did not meet Daubert standards. The court criticized the scientific merits of the willingness-to-pay approach. The court relied on the fact that there was no clear consensus on the exact methodology of the willingness-to-pay approach, as different economists often use different statistical adjustments to determine the value of a statistical life. Furthermore, the court pointed to a large error rate, as the value of a human life varied significantly across different studies, ranging from $1.6 million to $8.5 million (in 1995 dollars). In a more recent case, the court in Chavez v. Marten Transport (CIV. 10-0004 MV/RLP, 2012 WL 988008 (D.N.M. Mar. 22, 2012)) found expert testimony on the value of a statistical life inadmissible under Daubert for similar reasons.

Other courts have ruled similarly, although sometimes for varying reasons. In Cruz v. Bridgestone/Firestone North America (CIV 06-538 BB/DJS, 2008 WL 5598439 (D.N.M. Aug. 29, 2008)), the court declared that expert testimony on the value of a statistical life was inadmissible because the American sample population used in the studies on which the expert was to testify was not representative of the plaintiffs, who were illegal immigrants from Mexico. In Brereton v. United States (973 F. Supp. 752 (E.D. Mich. 1997)), the court rejected expert testimony on the willingness-to-pay approach because such an approach was inconsistent with the purpose of Michigan’s wrongful death statute, which was meant to compensate the deceased’s family members for loss of society, not to provide damages equal to the value of the deceased’s life.

Footnote Sources:

2 In re Estate of Ferdinand Marcos Human Rights Litigation, 910 F. Supp. 1460,1464-65 (D. Hawaii 1995).

4 W. Landes & R. Posner, The Economic Structure of Tort Law, 187 (1987).

5 Sherrod v. Berry, 629 F. Supp. 159 (N.D. Ill. 1985).

6 W. Kip Viscusi, The Value of Life in Legal Contexts: Survey and Critique, 2 Am. Law and Econ. Rev. 195, 201–08 (2000).

9 Albrecht, The Application of the Hedonic Damages Concept to Wrongful Death and Personal Injury Litigation, 7 J. of Forensic Econ. 143, 148 (1994).

10 See Havrilesky, Thomas, The Misapplication of the Hedonic Damages Concept to Wrongful Death and Personal Injury Litigation, 6 JOURNAL OF FORENSIC ECONOMICS 93 (1993); but see W. Kip Viscusi, The Econometric Basis For Estimates of the Value of Life, 3 JOURNAL OF FORENSIC ECONOMICS 61 (1990).

11 Viscusi, supra note 6, at 214-16.